# Generate efficient frontier

target_returns = np.linspace(mean_returns.min(), mean_returns.max(), 50)

efficient_portfolios = []

for target in target_returns:

# Constraint tambahan untuk target return

constraints_ef = [

{'type': 'eq', 'fun': lambda x: np.sum(x) - 1},

{'type': 'eq', 'fun': lambda x: portfolio_return(x, mean_returns) - target}

]

result = minimize(

fun=lambda w: portfolio_variance(w, cov_matrix),

x0=initial_weights,

method='SLSQP',

bounds=bounds,

constraints=constraints_ef

)

if result.success:

efficient_portfolios.append({

'return': target,

'std': portfolio_std(result.x, cov_matrix),

'weights': result.x

})

# Extract data untuk plotting

ef_returns = [p['return'] for p in efficient_portfolios]

ef_stds = [p['std'] for p in efficient_portfolios]

# Generate random portfolios untuk comparison

n_random = 5000

random_portfolios = []

for _ in range(n_random):

w = np.random.random(n_assets)

w /= np.sum(w)

random_portfolios.append({

'return': portfolio_return(w, mean_returns),

'std': portfolio_std(w, cov_matrix)

})

random_returns = [p['return'] for p in random_portfolios]

random_stds = [p['std'] for p in random_portfolios]

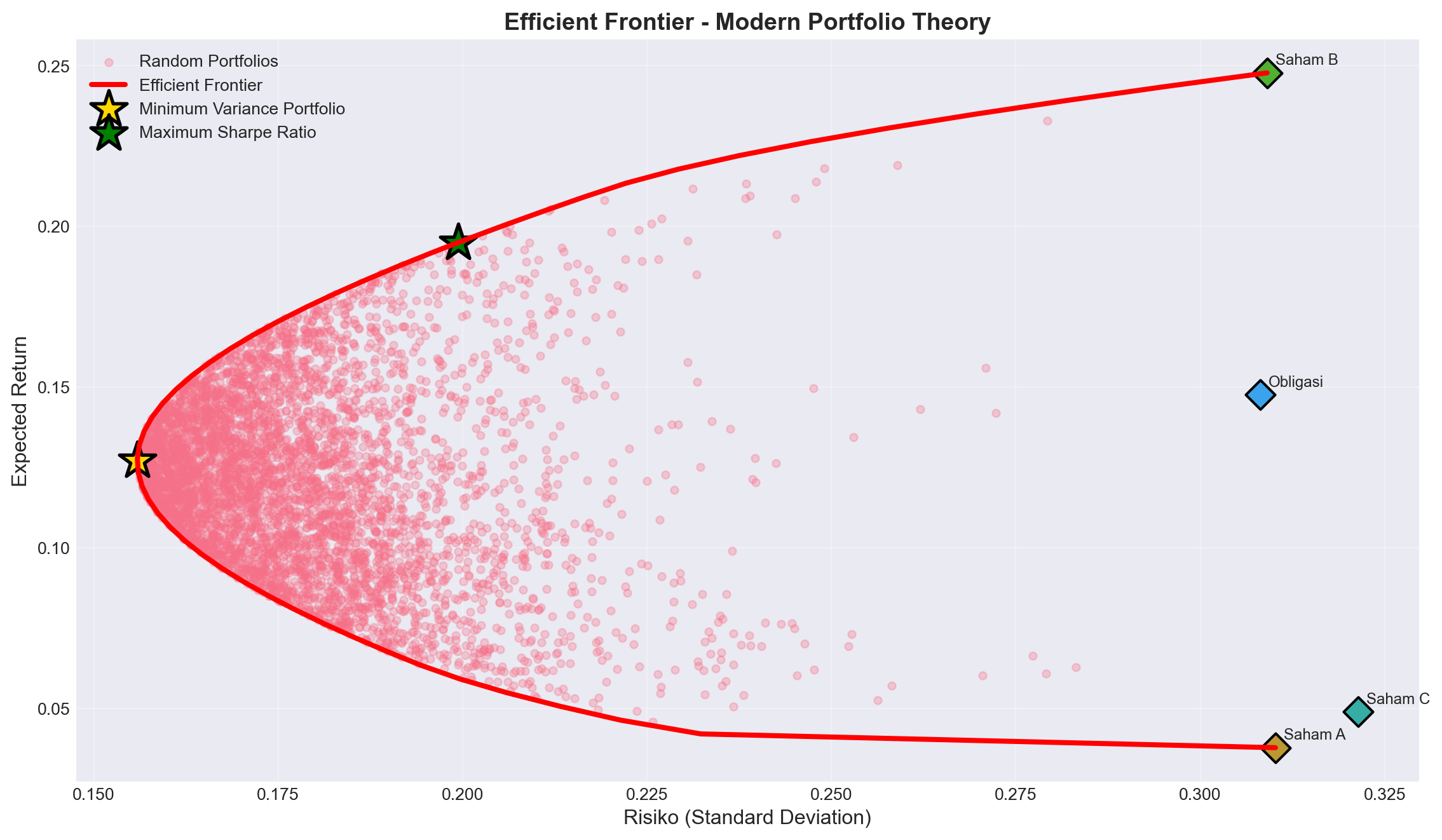

# Plot

plt.figure(figsize=(12, 7))

plt.scatter(random_stds, random_returns, alpha=0.3, s=20, label='Random Portfolios')

plt.plot(ef_stds, ef_returns, 'r-', linewidth=3, label='Efficient Frontier')

plt.scatter(mvp_std, mvp_return, marker='*', s=500, c='gold',

edgecolors='black', linewidths=2, label='Minimum Variance Portfolio')

plt.scatter(sharpe_std, sharpe_return, marker='*', s=500, c='green',

edgecolors='black', linewidths=2, label='Maximum Sharpe Ratio')

# Plot individual assets

for i, asset in enumerate(assets):

plt.scatter(np.sqrt(cov_matrix.iloc[i, i]), mean_returns[i],

marker='D', s=150, edgecolors='black', linewidths=1.5)

plt.annotate(asset, (np.sqrt(cov_matrix.iloc[i, i]), mean_returns[i]),

xytext=(5, 5), textcoords='offset points', fontsize=9)

plt.xlabel('Risiko (Standard Deviation)', fontsize=12)

plt.ylabel('Expected Return', fontsize=12)

plt.title('Efficient Frontier - Modern Portfolio Theory', fontsize=14, fontweight='bold')

plt.legend(loc='best', fontsize=10)

plt.grid(True, alpha=0.3)

plt.tight_layout()

plt.show()